Mobile Banking Apps Are Changing The Way We Bank, But That’s Just The Beginning

Fintech Trends Illuminate The Future Of The Industry

After decades of remaining tellingly stagnant, the financial industry is on the verge of an era of massive upheaval. A variety of new technologies, most rooted in the opportunities created by mobile platforms, have resulted in a world where ground long assumed to be firm is suddenly shifting. Industry watchers have a name for this coming flux: fintech.

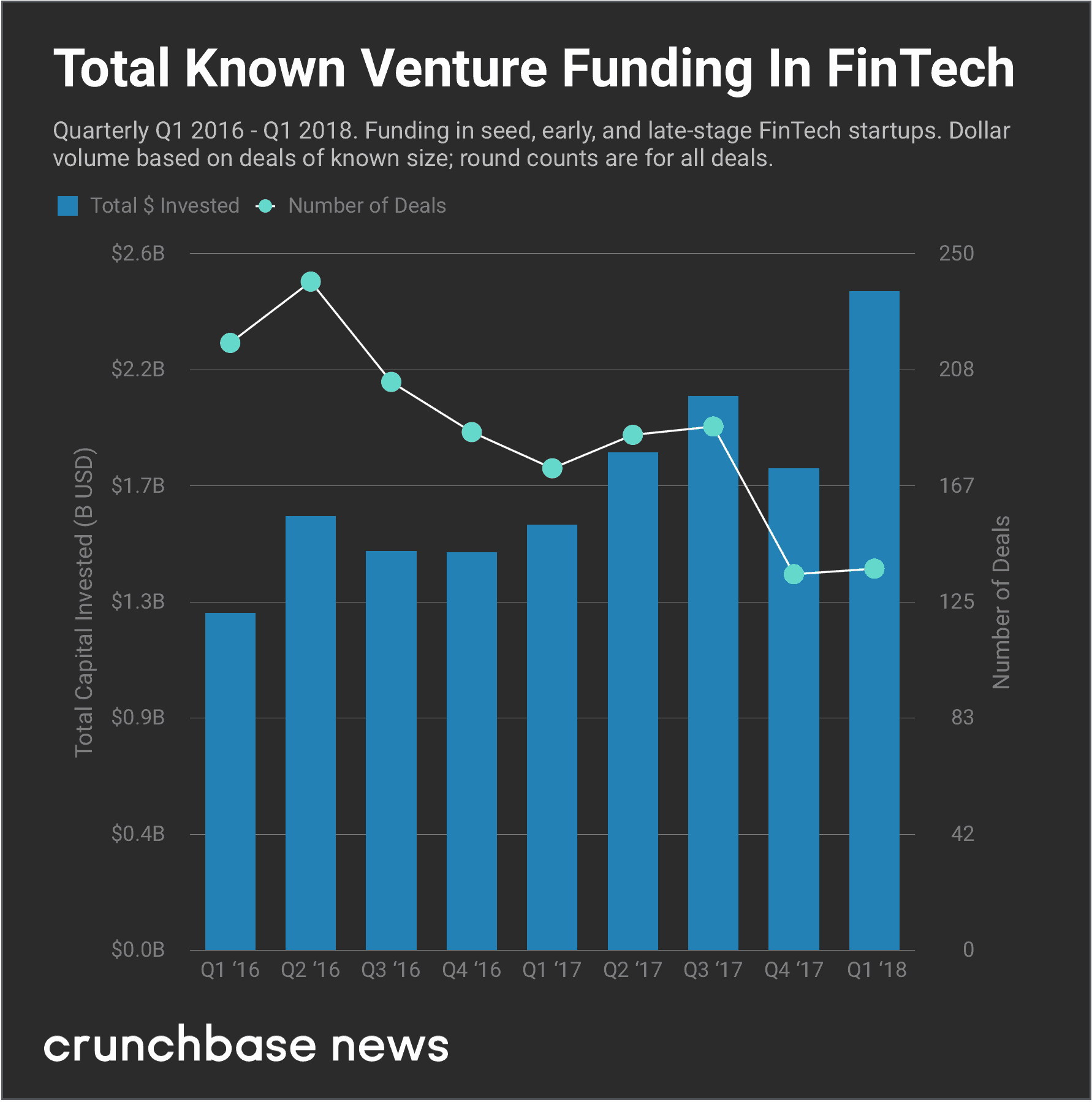

Investments in fintech solutions have positively exploded. Since 2016, more than $15.6 billion has been invested in seed, early, and late-stage U.S.-based FinTech startups. Simply from a investors perspective, the future of fintech is looking bright.

Source: Crunchbase News

It’s clear that a lot of change is just around the corner. Precisely how much change is impossible to predict accurately.

However, we can all be sure that the financial industry of the future will be more different and efficient. Trends point to a mobile world melting away the need for banks or stockbrokers. The following explores the future of fintech and the opportunities that will present the greatest gains for your business.

Blockchain Presents Opportunities to Make Fintech Banking Open and Transparent

The blockchain was one of the central aspects of the digital currency Bitcoin, and even those people who look down their nose at Bitcoin as being a flight of fancy for the millennial generation have acknowledged the potential held by this piece of the core software.

Simply put, the blockchain is an open ledger, an accounting of every transaction that is available to anyone. Each computer running bitcoin software operates as its node, making entries into that ledger in the form of “blocks”. Each block is connected to past transactions and shared across the entire network of independent nodes. Every transaction includes a whole history of every bitcoin transaction that preceded. It also comes with a time stamp and a hash connecting it to the previous block. The transactions are approved collectively by all of the other nodes.

Blockchain promises comprehensive data security by way of complete and total transparency.

But what sets it apart, however, is that it’s entirely decentralized. A single entity doesn’t maintain the ledger, it’s built, stored, and managed by all of its users collectively. You can’t hack the blockchain because you would have to alter the code across every node. All this, without anyone noticing that it’s happening or happened.

A Digital Revolution in Finance

For outsiders, the reason why the blockchain holds so much disruptive potential can be challenging to grasp. But to understand, you have to take the possibilities of decentralized record-keeping beyond just the improvement in data security. For ages, the essence of the financial industry is the banking institution. Large, centralized organizations based out of a single location. Because they were so integral to the business world, banks could wield enormous control over the flow of capital.

With technology like blockchain, permanently reversing this trend has the entire industry either scared or optimistic about its potential. A public ledger that can maintain itself could mean services traditionally offered by a bank could instead come from the crowd. A more transparent, democratic financial system wouldn’t allow its central players to exert so much control. Instead of a secretive and controlled system like traditional banking, blockchains are open to all and completely transparent.

The potential for a transparent, decentralized network of record keeping is already underway.

Examples Of Blockchain: Nasdaq

Nasdaq, for instance, has been an early adopter with, a blockchain-powered technology that maintains capitalization tables, which private companies use to track shares in their business.

Maintaining share structures can be arduously complicated, particularly for smaller companies trying to invest all of their resources into growth or R&D. Start-ups, everywhere, would benefit from a transparent system maintained by shareholders and immune to fraud.

Beyond that, it could indicate a future where stock exchanges themselves become entirely obsolete. The current system has serious flaws that allow high-frequency traders (HFTs) to take advantage of slower traders. Not to mention, investment banks continue to operate dark pools where stock trading takes place hidden from public eyes.

But what if there were no exchanges? What if every public company operated a blockchain to track any transactions involving their stock? Without the need for a centralized exchange to approve transactions, the potential for higher transparency and fairness in our public stock system becomes virtually unlimited. Anyone could trade stocks from anywhere without fear of fraud and without having to pay transaction fees.

Examples Of Blockchain: Ripple

Look at Ripple, a cryptocurrency focused on being a single-source for financial transactions. Banks have long relied on the difficulty of transporting funds to collect transaction fees. Ripple, however, creates a single currency maintained and tracked on a blockchain, giving anyone an easy way to move money. It might be incredibly difficult to transfer $20 to someone in another country, but Ripple is entirely digital. With Ripple, you can access funds from anywhere. Just turning your money into Ripple means you can send it somewhere with ease. Ripple may currently be experiencing difficulties with volatility.

Examples Of Blockchain: Ethereum

There’s also Ethereum, a blockchain-based system that functions on a “smart contract” basis, running programs that can’t be altered by third parties. The system has the chance to function as a “world computer,” removing the classic model of servers and clients entirely and opening up new opportunities to people around the globe.

Even if you’re not looking for a world-beating, paradigm-shifting technology, there’s plenty of more modest applications that are valuable nonetheless. Take the partnership announced in 2016 between Deloitte and Loyal to improve customer loyalty programs using blockchain. With better tracking of transactions, companies can also get more granular in identifying customers and tailoring loyalty programs to them.

VR/AR Enables Everything From Data Visualization to Live Product Information

Another area where there’s enormous potential for the top fintech startups to change the nature of finance is in virtual and augmented reality. While applications of VR/AR seem to focus on video games, there’s a number of ways that fintech could incorporate them.

Source: Citi Youtube Channel

Enormous amounts of data, collected from every corner of the globe, are the life’s blood of the financial industry. Analyzing that data can be incredibly difficult, and anything that can help decision-makers in the commercial world does this is worth its weight in gold. As such, data visualization is a crucial area for improvement and one where VR/AR technology is well suited. Developing applications that allow people to interact with data in a way that can help them identify and exploit trends or spot market inefficiencies could be enormously valuable.

For that matter, using VR/AR to supplement the customer experience when people interact with their banks can do a lot to repair the relationship between consumers and the banking industry. For years, banks have been relatively opaque institutions that did little to make the experience more satisfying for their customers, and a VR environment where people can intuitively interact with their accounts in real time could revolutionize the nature of banking.

VR/AR Can Improve The Customer Experience

Finally, retail shopping could also benefit. Imagine a world where people can shop in virtual locations, selecting items for their cart and paying automatically without needing to “check out.” It could meld the convenience of Amazon onto the more familiar retail shopping experience, allowing people to interact with goods before they buy while still shopping from home.

In-store augmented reality apps, likewise, could allow consumers to identify goods and access information about them right there in the aisles. In the struggle to compete with online stores, brick-and-mortar retailers can quickly enhance the in-store experience by allowing people to use their smartphones to interact with products and stores.

AI Offers Lower Costs And Less Friction Through Better Automation

Few things create the same sort of concern about the future as the concept of AI. Years of science fiction films have left us wary of the potential for self-aware computers. Present-day luminaries like Elon Musk have even cautioned against AI.

However, the present iteration of AI in fintech has already revolutionized much of the financial industry. Better automation of business processes means lower fees and transaction costs for consumers, savings that can mean a broader access to services.

Automated accounting apps have made the careful tracking of your finances online, and straightforward programs designed to help file your taxes are rapidly making the CPA a thing of the past. Investing has also changed. The cost of achieving “BETA,” essentially matching the returns of the broader market, has dropped rapidly. Plenty of apps are offering easy investment advice based on automated programs that can help anyone get a healthy return without paying fees to an advisor or mutual fund.

Apps like Acorns allow people to invest minimal sums of money using automated investing strategies that are easy to understand and cost very little to use. Likewise, SigFig is an app that will help people optimize their portfolio by examining their holdings and doing an automated assessment of what sorts of assets best serve their needs.

The lending industry has also seen how automation can mean lower fees and rapid expansion of services. When every loan required careful consideration by an individual loan officer before underwritten, banks needed margins to turn a profit. With an automated process, banks can afford to offer a lot more loans. Kabbage, for instance, is taking advantage of a digital loan process to expand the availability of small business loans.

Without Improved Security, The Industry Will Struggle to Expand

A more open, transparent financial industry has the potential to make life easier for hackers as well. Closely guarded business information has been an essential piece of the financial industry for generations. No amount of positive change would be able to counterbalance a loss in security.

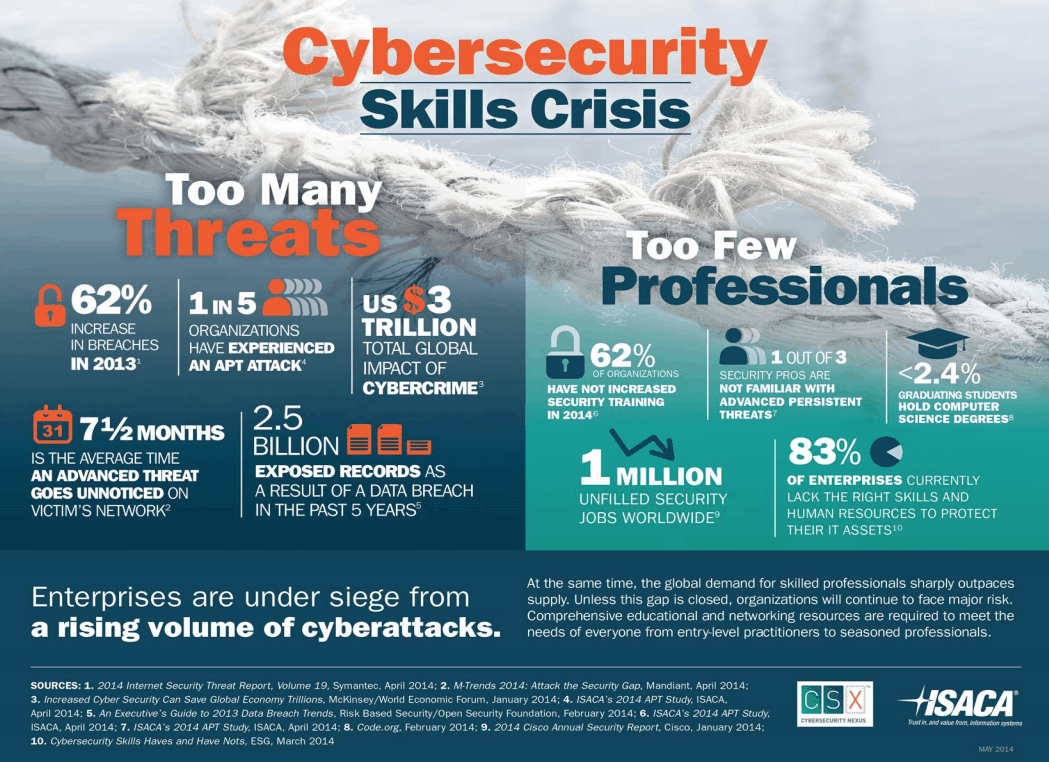

Source: ISACA.org

Indeed, the early track record of data security and the internet has its share of horror stories. The Equifax breach is one of the most recent. While the practices at Equifax that allowed this breach warrant scrutiny, the broader truth is that fintech is rapidly increasing the amount of financial information transmitted each day.

Improved Security Means Wider Adoption

If you want people to go outside their comfort levels to build a new mobile app, security is crucial. If Equifax can see its reputation ruined, start-ups will not survive if it fails customers in the same fashion.

Fortunately, the top fintech companies provide plenty of options to ensure hackers don’t have access to sensitive data. A variety of technologies are helping make the process of identifying users easier, simpler, and more secure.

- Biometric Data – Instead of a password or pin code, what if access to your accounts required a fingerprint or even your face? Hacking accounts would become much harder and fraud next to impossible. New mobile apps are already making use of this technology to keep your financial information more secure.

- Algorithmic Tracking – Of course, not only do our bodies provide unique markers, but our behavior does as well. Using big data to identify types of transactions that indicate fraud can mean quickly shutting down vulnerabilities before they can start.

- Greater Transparency – Keeping things in the open is another essential method for staying safe. While that may seem counterintuitive, the sort of security provided by a blockchain is virtually impossible without the collective efforts of everyone on the chain.

Biometrics is an area that could help bridge that divides. Imagine accessing your bank account with your fingerprint, or even just taking your picture with facial recognition software. Not only would users no longer need to remember different passwords, but their accounts would be even more secure.

Fintech Technology Trends: Rapid and Positive Change is on the Horizon

The fintech sector is an umbrella term covering a wide range of tech developments in the financial industry. At the moment, it’s still difficult to completely understand how this industry will look like in ten or twenty years. Fear of the unknown can be a real obstacle, but it is important to focus on what can be achieved.

Fintech business development presents an opportunity to create solutions that can help people engage with their financial information in new ways. Securing that data could be the necessary push igniting a wave of real change in the finance sector.

Whether it be revolutionizing banks or sending money to friends, the latest fintech trends present opportunities for anyone to build something truly innovative.